The n8n Automation Solution for Financial Services

Create secure, compliant workflows that reduce operational risk while improving efficiency and client satisfaction.

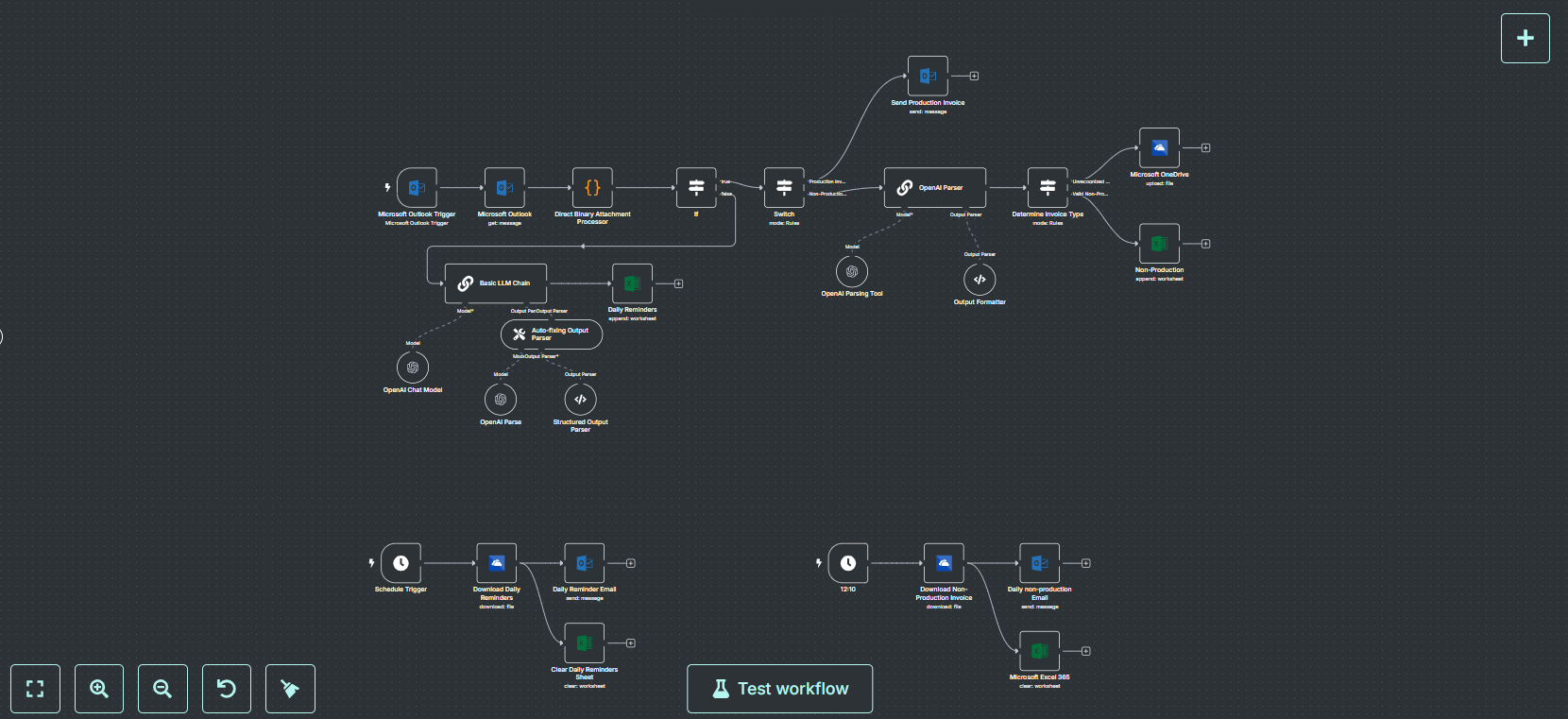

How n8n Transforms Financial Operations

n8n is the ideal automation platform for financial institutions needing secure, compliant, and audit-friendly workflow solutions:

- Connect your core banking, CRM, document management, and reporting systems

- Create automated approval workflows with proper segregation of duties

- Implement automated compliance checks and documentation

- Build secure client onboarding and KYC verification processes

- Automate regulatory reporting with detailed audit trails